What would you say about Reddit going public? Reddit Inc, famous for its message boards that became target for day dealers during last year’s meme stock hysteria, announced on December 15, that it had filed for an initial public offering with US securities regulators in a confidential manner.

Reddit, founded in 2005 by Steve Huffman and entrepreneur Alexis Ohanian, was valued at $10 billion earlier this year in a private fundraising round.

According to Reuters, the company is hoping for a valuation of more than $15 billion by the time it goes public.

The filing comes as US IPOs hit all-time highs in 2021, fueled by abundant liquidity as a result of accommodative monetary policies. Some of the companies that have gone public during the last year in the United States include Robinhood Markets Inc, Coupang Inc, and Coinbase Global.

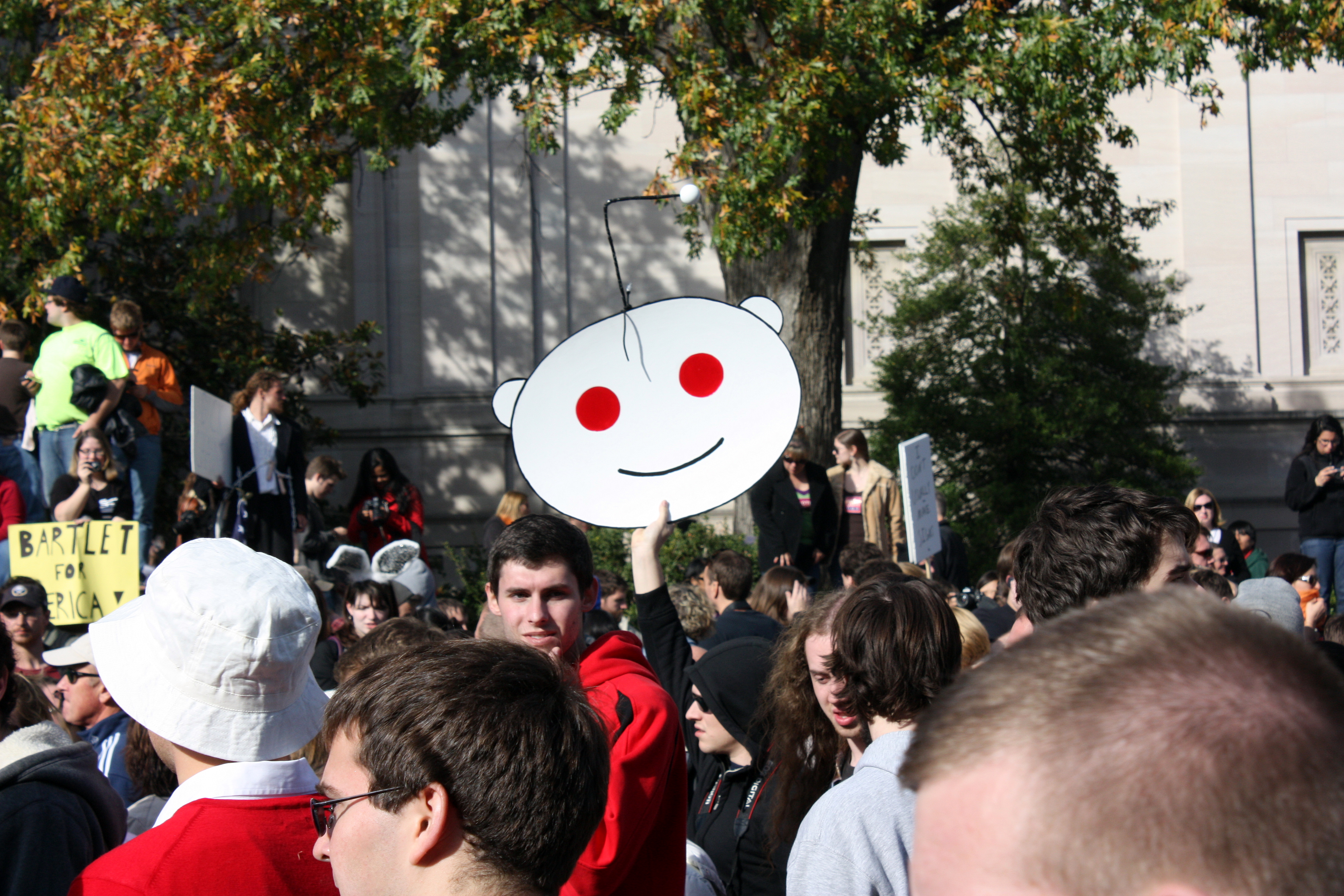

Reddit had over 100,000 communities, or “subreddits” and approximately 52 million daily active users, as of October of last year.

Retail investors flocked to its message boards at the start of the year for trading tips on GameStop Corp and other so-called meme stocks, resulting in explosive growth for the company.

Reddit, based in San Francisco, reported $100 million in advertising revenue in the second quarter, a nearly threefold increase over the same period last year.

Drew Vollero, Snap Inc’s first finance chief who guided the company’s transition to a public company, was hired as the company’s first chief financial officer in March.

Andreessen Horowitz, Sequoia Capital, Fidelity Investments, and Tencent Holdings are among the company’s largest investors.

In the certificate of registration filed with the US Securities and Exchange Commission, Reddit did not disclose the number of shares to be offered or the price range of the IPO.

Could you ever have guessed about Reddit going public? Share your thoughts in the comments below.

You’ll also like to find out why FIFA is reportedly ending its 30-year partnership with EA Sports.

0 Comments